When you have the right tools, the job is ALWAYS easier. And it’s no different with your finances – the right tools make all the difference.

In the past few weeks, I’ve received a number of questions from readers about the specific tools that we use to manage our finances. Many of the questions are the result of my previous posts about money. You may want to review them – they’ll add value to this post:

- How We Saved More Than $50,000 in 4 Months. This is the story of our journey early in our marriage from debt to financial freedom. It’s not a get-rich-quick post – not by any stretch.

- Our 8-year-old buys her own clothes, has saved thousands for college, & has ½ of her first car paid for. In this post I explain how we are actively teaching our children how to manage money.

Now, here are the 5 essential tools for managing money:

1. The Basics

You need vision. A goal. And a plan to get there.

This is the one hurdle that trips up most people. But don’t quit reading just yet.

Yes – your situation seems hopeless. You feel like you’ll never be free of debt. It seems like every month something steals away every last dime of your savings.

No matter how much you make – $10,000 or $100,000 – you’re still living paycheck to paycheck. And you’ve tried every plan and program – they just don’t work for you!

I get it. Well – I did before I went through Dave Ramsey’s Financial Peace University a few years ago.

His simple 7-step system of baby steps put us on a path to financial freedom. I won’t detail the 7 principles in this post, but you can read them here.

Let me explain – years ago, we had more than $100,000 in unsecured debt (not including homes and automobiles). Although we were victims of unfortunate circumstances, we made a decision that were not going to file bankruptcy or default on our obligations.

By getting very focused and working very hard, we paid off all of the debt in just a few years. And today do not have any debt other than for real estate. We have been paying cash for vehicles for more than 8 years.

We are simply following the principles we learned in Financial Peace University.

So start with a plan. Know what you want and have a plan to get there. Then start.

And don’t give up! Ever.

2. Budget

A few months ago Madison (our 8 year-old) walked into my office one evening and announced, “Dad, Mom said I really need to get glasses.”

I had been putting it off because I wasn’t sure she REALLY needed them – in part because I was too cheap to take her to the eye doctor. And in part because she was wearing faux glasses she bought for 3 bucks at Claire’s.

So I continued to type as I responded, “OK, baby – we’ll see.”

Unconvinced, she continued – “Dad, I really need them – I can’t see the board at school. So you need to include it in the…the…b-word.”

Needless to say – that got my attention!

And this should get yours – You need a B-WORD – a budget!

I know – I know. You’ve heard it before. But it matters. In fact, a budget is the foundation for your financial success.

You can access sample budget forms here.

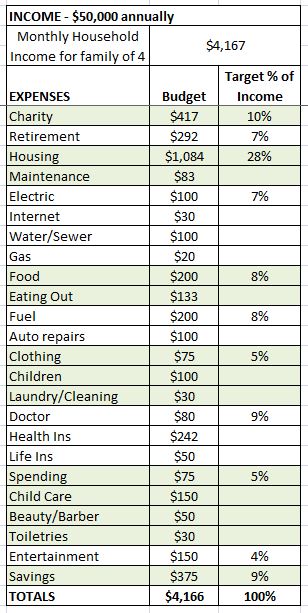

Here’s a sample budget for a family of 4 with an annual household income of $50,000 (take home pay after taxes):

3. Spending Plan

This is the piece that I didn’t understand for a long time. I would get to the end of the month then compare my spending with our budget – O crap! We went over again. There. And there. And there. And…how’d we go over there?

An effective spending plan will always include 2 disciplines:

1. You literally need to spend every dollar on paper before you actually get paid.

Know what you are going to do with the money before you get it. If you don’t – well, you know what will happen.

So, a few days before each pay period I record what my paycheck is going to be. Then I account for how we are going to spend it all.

Then, when the paycheck comes, I am less tempted to spend it on a grill, on furniture, or on a new iPhone. Because the money is already gone.

Here’s what a spending plan might look like for a family of 4 during a typical month:

2. Track your spending throughout the month real-time.

You won’t be able to do this by glancing at your account balance in the Chick-Fil-A drive-thru. I’m sure you’ve figured out – that won’t work.

I don’t recommend carrying around significant sums of cash in Dave’s envelope system – most of the time I don’t have any cash on me. And my budget spreadsheet and spending plan is at home when I need to know if I can spend money.

We needed a tool to keep us from overspending with debit cards.

We found the EEBA (Easy Envelope Budget Assistant) app to track our spending. It allows you to enter your budgeted amounts each time when you get paid into categories that you preset.

Then you simply enter expenses as you make purchases. The app deducts it from your monthly budget and displays how far ahead or behind you are for the month.

EEBA syncs in the cloud so my wife and I always have access to our remaining budget balance even when we are not together.

4. Financial Software

We use Quicken to track personal finances and Quickbooks to track our business finances. And we track everything.

We even track the cash that we spend. Because we want to understand our spending habits so we are able to make adjustments as needed based on reliable information.

The software helps significantly when it comes time to prepare your tax return. In about 30 seconds, you can print one report that contains all the information you need to file your return.

5. Review

This week, I read a story about a finance manager of a dental office in Georgia who embezzled more than $2 million dollars over an 18-year period.

First of all – this dentist must have some kind of business going not to miss $2 million dollars! More importantly, How does this go on for 18 years without being discovered?

There’s only one way – no one was reviewing the books!

If you are going to be successful, you must regularly review your finances to make sure you are staying on track.

My wife handles most of the transaction entry for our family finances. Each Saturday I review our spending for the week.

At the end of each month, I run a simple report to compare our spending with our budget. I want to know if we overspent in an area. If we track our spending as described above, there should be no surprises here.

Then, I review our budget and financial goals at the end of each year and make adjustments as necessary.

What other tools do you recommend for managing personal and business finances? Share your ideas in the comments.

Thanks for sharing these 5 essential financial tools with us. It’s much appreciated!!! I can now apply the tool i have been missing for a great financial turn around.

Memorizing the 5 tools – The Basic ( vision or goal for spending), Budget, Spending plan, Financial software and review. Great!!! Will constantly do more reviews!!

Amazing how a few envelopes turned our finances around. We were never in a lot of debt, but we were sloppy and wasteful. Just taking control by creating a budget helped us feel like we were getting ahead. I haven’t had a car payment in forever (and never will again) and only owe on the house. We are huge Dave Ramsey fans and I’ve facilitated Financial Peace at our church a few times… Great post!

You’re right – it does make a difference, Tom. I appreciate your encouragement.

Good idea to keep it in front of you – it provides another level of accountability (no pun intended), especially as children grow up and observe the disciplines you are living.

We use the YNAB (You Need A Budget) app. It works on all our computer or mobile devices and syncs to Dropbox. It helps you plan ahead and match what you have left to spend in each budget category. It’s the best tool we have used so far (and we have tried quite a few). Watching their video tutorials opened our eyes about how we were going off track: spending based on what is left in the bank account, not out of the amount that is unspent in the budget. You can quickly add transactions to your budget as you spend with your mobile phone. It’s good stuff 🙂

http://www.youneedabudget.com/

My brother and his wife use YNAB. I like how it works. I’ve not watched the tutorials – good tip.

We modified the envelope system and use no-fee gift cards for specific budget plans, like groceries and gas.

The fringe benefit is that we use a reward-providing credit card to make the purchase, immediately pay off the balance, and the points build up.

We have to watch and make sure it stays “no fee” but that’s worked for a couple of years now. The gift cards are listed in Quicken just like an account, and transactions go in and are tracked, just like using the debit card or credit card. But every few months, it generates enough reward points for a few dollars off at Amazon or somewhere else, which helps with the debt snowball (step 2…) in recovering from the housing market falling on our heads.

Yes – with my travel schedule, we do a few similar things. The key is to continue to track the spending so you know where the money is going. Great ideas!